What Is the Best Supplemental Insurance Coverage?

Having a good health is very paramount. When you have a good health, it boosts your life expectancy to a significant extent. The point is that if your body is healthy and stays away from diseases and injuries, you will be able to live a very comfortable life. And only a comfortable life can ensure that you will live for long. Hence, one must take his health with utmost seriousness. There are various health insurance plans which one would have to choose from. At all times, people want to choose the best health insurance plan from all the options available. Hence the question is, what is the best supplemental insurance coverage out there? But before answering this, we need to know what supplemental insurance coverage is.

What is supplemental insurance coverage?

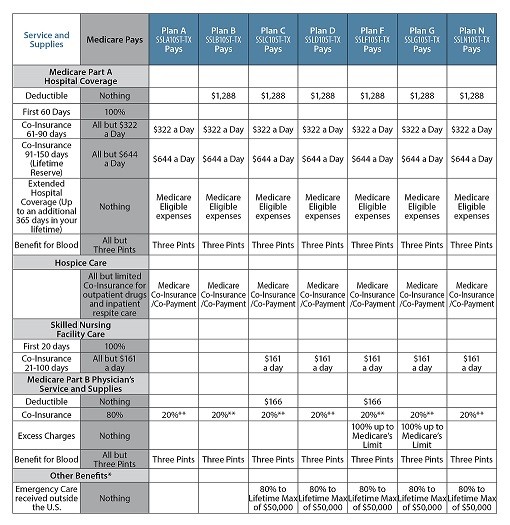

Supplemental Insurance Coverage, also known as Medicare Supplemental Insurance, is a Medigap Plan. The supplemental insurance coverage is sold by those companies owned by individuals. It helps settle some healthcare costs which are not covered by Original Medicare. Examples are deductibles, coinsurance and co-payments. There exist different supplemental insurance coverage and according to some recent statistics, the best supplemental insurance coverage is the Medicare Part A. Medicare Part A is the best supplemental insurance coverage because it covers all the benefits attached to the Medigap policies.

Medicare Part A covers the following:

- Home health services which are usually limited. Examples include severe access hospitals, acute care hospitals, long term care hospitals, etc.

- Hospital care which is only for inpatient.

- Hospice care.

- Care at skilled nursing facility. This is usually offered so that custodial care would not be the only care needed.

Medicare Enrollment is now Open! Apply or Make Changes

Connect with a Medicare Enrollment Representative by phone, call: 1(855) 848-8112